PHILIPSBURG – In view of the coming elections 2016 in St. Maarten, the Concordia Political Alliance (CPA) party reached out to Benjamin & Parker (BP) Certified Risk Auditors after conducting a scan in the consultancy market in the region, with the objective to develop a new concept to achieve the simplification of the local taxation method effectively.

Benjamin & Parker is a consultancy company versed in High Impact Risk Management and their team consists of certified professionals from Panama, Colombia, The Netherlands, Ecuador, The USA, and the Dutch Caribbean in various financial areas. The firm accepted the challenge to dissect the current methodology, create an innovative fiscal concept that will emphasize efficiency to relieve the Tax Office burden, while zooming in on the actual business culture to mitigate tax evasion practices, with focus on consciousness and awareness of the St. Maarten citizen to declare their income in a simplified manner.

Benjamin & Parker’s fields of expertise are Corporate Cost Savings, Efficiency enhancement and Progressive Revenue evolution, which are master keys to the existing problems in the local taxation cycle.

Management of BP indicated that times have changed and the tax system must be adapted, starting with eliminating the Dutch taxation culture, to improve the social economic platform by making St. Maarten financially attractive for local and foreign investors. The representative of BP stressed that adapting the taxation system with business culture promotes employment and employment generates tax revenues.

St Maarten has been confronting the following taxation problems: Bulk taxations are forced on the business community and the citizens without considering the economic impact hereof; Increase of unemployment and returning graduates fall in the unemployment pool or faced with lower paying jobs; and the tax bills cycle is circuitous.

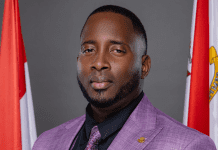

CPA party Leader Jeffrey Richardson contacted Benjamin & Parker Head Office expressing his concerns about the ongoing tax inconveniences after CPA assessed the root of the existing inconsistencies, and found it necessary to step to the plate to relieve the tax burden on both ends – the Tax Office and the tax paying community – by presenting an Efficient Tax simplification.

The Benjamin & Parker’s assessment aims to secure accountability of funds, outline the current waste within the tax collection cycle and describe the remedial actions to trigger and promote Government income by simplifying the taxation method, in conformity with good governance and efficiency guidelines.

Richardson and BP Latin American Regional Director Terence Jandroep CRA were classmates 3 decades ago and graduated together in 1985 with degrees in Business Economics.

The combination of ideas, expertise and thorough scanning of the systematic taxation circuit, are the basis for the analysis, which will be presented first to the press, and then made public to the voting community of St. Maarten.