With the prospect of cruise passenger arrivals, the Island’s main source of revenue, expected to decrease by 22%, as testified before Parliament earlier this year by the Florida Caribbean Cruise Association along with the 19-member cruise alliance, the economy of St. Maarten appears to be in a downward spiral.

This is quite evident by the fewer recorded ships that have been visiting the island, the loss of cruise lines to other islands and the less than optimistic view of businesses as to the economic future of St. Maarten.

Consequently, under a St. Maarten Christian Party (SMCP) administration and as member of the Parliament of St. Maarten, I will foster and champion all efforts to increase the island’s economic activity/economic development by promoting and sustaining small businesses. Much like across the Caribbean and worldwide small businesses are the driving force of St. Maarten’s economy.

Based on the Commercial Register of the St. Maarten Chamber of Commerce & Industry 96.0% of the businesses are small businesses. Those businesses with less than 100,000 guilders in capital investment are categorized as small business, while those with capital investment of more than 100,000 guilders are categorized as large business.

The SMCP and my objective is to build on economic activity/growth through small businesses and create jobs across St. Maarten. The approach here will be broadly based on providing small business with greater access to a combination of education, investment capital and business support services.

I find it rather unfortunate that the Small Business Association (SBDF) here on the island has been out of commission with its doors closed for the past few months due to lack of funding by government. This entity was supposed to be one of the main contributors towards educating our own as it relates to small business. Our proposed education aspect will focus on teaching small business owners practical skills to build and maintain their business. Among the skills: gaining insight into business management, the skills necessary to recognize (new) opportunities and ultimately practices that will increase business growth.

The capital aspect is to allocate public back funding or to provide loans to small businesses through consortiums to qualifying small businesses that lack access to affordable investment capital or may not qualify for traditional sources of credit (commercial bank loans). Through these sources small businesses would have access to needed capital to build, expand and succeed (in business).

As for the business support services, this will include: one-on-one business advice, the opportunity to learn from other like-minded experience business owners (networking) and the availability of expert and technical assistance for small businesses from professionals through government designed business development programs.

Besides providing small businesses with greater access to a combination of education, capital investment and business support, efforts will be made to reduce the TOT (turn-over tax) and the deduction of the present 34.5% profit tax rate for small businesses to further encourage growth and investment/economic development.

To offset any likely decrease in revenue, as a result in tax reductions, which I feel will be at a minimum with the anticipated economic growth, every effort will be made to strengthen the business tax collection process and to collect the millions of guilders in outstanding or uncollected taxes.

In addition, expansion of the economy will be sought. Expansion in terms of introducing new business industry sectors into our economy, i.e. technology base businesses, international call centers, etc., while boosting our main tourist industry by implementing a comprehensive cruise passenger conversion program (the conversion of cruise passengers into stay over guest) and developing other areas such as eco-tourism, faith-based tourism and creating events that contribute to increased numbers during what is called the off season.

It is worth mentioning that the reported proposal to adapt and implement an indirect tax system/sales tax, possibly in lieu of the direct tax system/income tax, could have an adverse effect on our main tourism industry, and as such should not be entertained.

St. Maarten has always been marketed as a sales tax free destination. The introduction of a sales tax could discourage tourists from choosing St. Maarten as a vacation destination. Not to mention it would diminish the buying/spending power of all people, thus stagnating economic development.

The vision here seeks to build economic prosperity in St. Maarten where all businesses can thrive. It prioritizes efforts to ensure economic growth for businesses, supports an educated/well informed business environment, provides opportunity to access investment capital and encourages investment. Consequently, the vision leads to economic opportunity and mobility for all citizens, provides citizens with access to good jobs and good income. This vision seeks to build an economic prosperous St. Maarten.

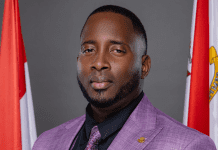

Keith Peter J Gittens

Candidate #2, St. Maarten Christian Party

“Together We Can”