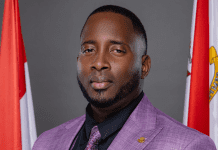

PHILIPSBURG, Sint Maarten — Pensioners being taxed on their pension income is a great concern to MP Claudius “Toontje” Buncamper, leader of the United St. Maarten Party (USP) faction in parliament, who on Monday sent a letter to the minister of Finance, Ardwel Irion, regarding the levying of income taxes on pension.

In his letter to the minister MP Buncamper mentioned that pensioners are dissatisfied with wage/income tax being levied to their already low pension income, especially in these challenging times when the pension might be their only source of income. The MP did not stop short to acknowledge the fact that pensioners have benefitted from the deductions of their pension premium payments from their gross salaries, while government had to sustain that loss of income.

MP Buncamper, who is considering the possibility to discontinue levying wage/income tax on pension income, submitted a number of questions relevant to his concerns to the minister of finance. The MP asked the minister if his ministry is considering the possibilities to cease levying wage/income tax on the pension income? And, if so, what plans are there in place to do so and what timeframe is proposed for such?”

Buncamper inquired from the minister how much additional income would government stand to generate if the pension premiums of all working residents were no longer deductible from the gross salary, and the income tax was to be calculated based on the gross taxable salary?

He also queried if it would be beneficial for government to levy taxes on the gross salary (without deducting the pension premium payments) and cease levying taxes on pension income, and how much government would stand to lose or gain? MP Buncamper queried if government will have a solution to cover the such loss, if any, in the 2022 budget.

MP Buncamper is of the opinion that if the premium payments are no longer deductible, then the pension income can be exempt from income tax.