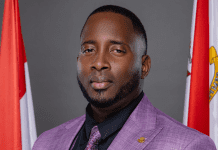

PHILIPSBURG, Sint Maarten — In a press released Terence Jandroep CRA CQA CLA, from Prudential Tax Services explains, Before, During and After the Covid Pandemic, the Dutch Caribbean has been facing the same conditions for the last 3 decades. Fact is that Government’s solution to all financial inconveniences is Taxation, and with pressure from Holland to make situation worse.

From a Risk Analyst perspective this action is a very unbalanced measure because all Governments in the Dutch Caribbean, direct taxation maneuvers on the active participants of the economy however does not even mention the creation of jobs, which will generate tax revenues, in order avoid further unnecessary taxation that has proven not to work in the last 3 decades.

Aruba, Curacao, Bonaire and Sint Maarten has been through this evolution over and over and always land in the front door of Holland. The angle of creating an employment pool is not mentioned anywhere or even discussed in Parliament in the Dutch Caribbean. This condition is exploited by Stakeholders (Holland) with strict conditions and slowly is penetrating more in the internal controls of the islands, unless this action is reversed

It is time for the Governments within the Dutch Caribbean to investigate the business culture and adapt to the derived conditions to create an employment pool. Governments must realize what is necessary for (local & foreigner) investors or new entrepreneurs to finance any project:

- a)The investor must foresee a long term economic benefits

- b)The investor will seek the possibilities to reduce their business risk

- c)The investor must realize that there is the opportunity to grow

- d)The cost of doing business must be economically viable

Unless the Dutch Caribbean adapts to these conditions, unemployment will continue to grow, Funds from Holland will be necessary and tax evasion will happen.

It is so simple yet seems too difficult to implement because if contradicts the mindset of the progressive taxation system that the Dutch Caribbean is embedded in our politicians mental dynamics.