PHILIPSBURG, Sint Maarten — Social & Health Insurances SZV and Audit Team Sint Maarten (ATS) are calling out to employers and asking them to give urgent attention to their SZV employer obligations and to adhere to the stipulated laws. Full cooperation is requested by the business community to ensure that the routine compliance controls by ATS and SZV are executed smoothly.

Employers can be proactive by logging into their Employer Portal account and ensure that their company information and employee registry is up to date, take note of any outstanding premiums to be paid and contact SZV via the portal for a payment arrangement, if necessary. The compliance controls conducted by ATS will include recipients of the SSRP COVID-19 Business Payroll Support.

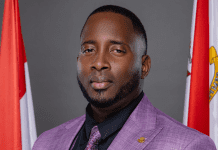

“These compliance controls by SZV and ATS are not new. However, they have proven to be very necessary due to the increasing trend in non-compliance. At SZV, we’ve made it possible for employers to have full access to their SZV administration, 24/7 online. Receiving and assessment or a reminder should no longer come as a surprise, because in fact, you can see in your portal account what your outstanding is and that you are late with filing etc. If you are unable to pay the full amount, you can also directly request a payment arrangement in the portal. Since 2017, all registered businesses with employees must have an Employer Portal account. And for those that are not aware of the procedures, the teams of ATS and SZV regularly give in-person guidance. We’ve made compliance more obtainable, offline and online. We continue to ask for full cooperation, so the social security system of our country can continue to work for those in need.” – Mr. Glen A. Carty, SZV Director

The Social Security Ordinances executed by SZV are based on a solidarity principle where all persons, with an income, pay social & health insurance premiums. These premiums are used to pay for the costs of various social and medical care benefits of those entitled. Examples of these include: hospital medical care, medical care abroad, prescription medication, medical aids, old-age pension benefits, widower’s pension benefits, orphan pension benefits, loss of wages benefits, severance pay benefits etc. Without improved compliance by employers, the risk becomes greater that the social security system becomes unsustainable for future generations.

ATS was established in 2016 by Social & Health Insurances SZV with the main objective to increase compliance in payment of the legally indebted social security premiums and to promote that all companies pay their fair share in accordance with the Social Security Ordinances. Companies are always encouraged to make a proactive effort to maintain open channels of communication with SZV and ATS, as their partners in compliance.