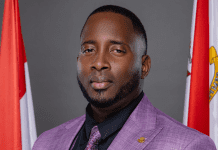

Willemstad/Philipsburg – ” Without doubt, fiscal consolidation is necessary to put the public finances in Curaçao and Sint Maarten on a sustainable path and to create fiscal space to confront any future adverse economic shocks. However, fiscal consolidation should be achieved in a gradual and structural manner so that it does not inhibit economic growth”, states Richard Doornbosch, President of the Centrale Bank van Curaçao en Sint Maarten (CBCS) in its most recent Economic Bulletin of March 2022. In this regard, a fiscal consolidation path should secure room for public investments.

Doornbosch underscores that the fiscal consolidation plan should be based on a four-year

timeframe, includes operational targets to cover both the expenditure and revenue side of the budget, uses cautious assumptions on economic growth and public finances, and sets clear priorities. Furthermore, on the expenditure side, the governments should strengthen public financial management, while on the revenue side the implementation of tax reforms is crucial.

“To be growth-friendly, the fiscal consolidation plan should also secure room for public

investments. Curaçao and Sint Maarten could benefit from the positive impact of public

investment on economic growth, particularly in difficult economic times”, Doornbosch argues.

Between 2011 and 2021, the share of public investment in GDP averaged only 2.5% in Curaçao and even a mere 1.6% if the construction of the hospital is excluded. Meanwhile in Sint Maarten, public investment averaged only 0.8% of GDP between 2011 and 2021.

The extent in which public investment will result in higher economic growth depends on the size of the so-called fiscal multipliers. Fiscal multipliers measure the short-term impact of discretionary fiscal policy on output.

In other words, fiscal multipliers indicate the gains of expansionary fiscal policy or the costs of contractionary fiscal policy on the economy in a given year. Given the high degree of openness and smallness, fiscal multipliers are relatively low in Curaçao and Sint Maarten

as public expenditures have a higher import leakage. Nevertheless, research has shown that in “abnormal” times, fiscal multipliers tend to be higher than under normal economic circumstances.

Also, in the longer term, public investments have a higher contribution to output growth than public consumption. “Contrary to other developing countries, Curaçao and Sint Maarten have the possibility to borrow against relatively low interest rates because of the standing subscription rule. However, an important precondition for scaling-up public investment is that the governments choose and manage their investment projects in such a way that economic returns are maximized.

In this regard, a well-designed public sector investment program is recommended in which investment projects are prioritized and assessed based on their costs and benefits and contribution to sustainable long-term growth. Also, the program should include norms for guaranteeing the quality of investment projects and the efficiency of resource allocation”, Richard Doornbosch concludes.

The complete text of the Report of the President and the Bank’s Economic Bulletin of March 2022 can be viewed on the Bank’s website at https://www.centralbank.cw/publications/economicbulletins